GENERAL RULES

DO’s:

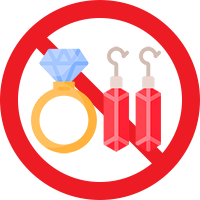

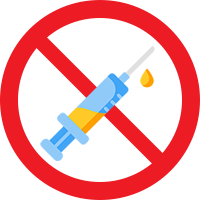

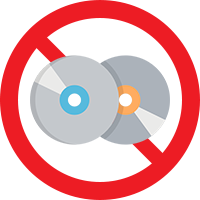

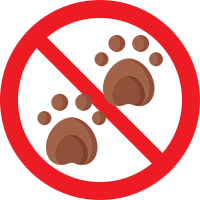

DON’Ts:

PROHIBITED GOODS

Parcel To Post will not entertain or accountable for any subsequent charges, fines and compensation which may be incurred if the declaration of items is deemed false, incomplete, dubious, or contradictory to the declaration made by sender prior to posting.

Please refer to the guidelines and always check the countries rules before sending your shipment.

DANGEROUS GOODS

Classifications |

Hazard |

Examples |

| Class 1 | Explosive |

|

| Class 2 | Gases |

|

| Class 3 | Flammable liquids |

|

| Class 4 | Flammable solids; substances liable to spontaneous combustion; substances which in contact with water, emits flammable gases |

|

| Class 5 | Oxidizing substances and organic peroxides |

|

| Class 6 | Toxic and infectious substances |

|

| Class 7 | Radioactive material |

|

| Class 8 | Corrosive substances |

|

| Class 9 | Miscellaneous dangerous substances and articles, including environmentally hazardous substances |

|

REFERENCES

Malaysian Civil Aviation Act 1969 No.66 &67,

Act 3 Malaysian Civil Aviation Act 1969

Regulation 188 (Penalty)

- 1st Offence: Individual fine RM 50,000 and /or not more than 3 years imprisonment.

Corporate: RM 100,000 - 2nd Offence: Individual fine RM 100,000 and /or not more than 3 yrs imprisonment.

Corporate: RM 150,000

- 1st Offence: Individual fine RM 50,000 and /or not more than 3 years imprisonment.

Malaysian Civil Aviation Act 1969 (Regulation No.67) Carriage of Dangerous Goods.

CLEARANCE INFORMATION

IMPORT DUTY AND TAXES

Importation of shipments may attract duties or taxes or both.

Import Duties

- Import Duties are imposed to shipments based on the items (0% – 30%)

- Calculated based on the CIF value of the shipment

- Duties are exempted if importer is in bonded area, designated area, Licensed Manufacturing Warehouse

Excise Duties

- Excise Duties are imposed on controlled items defined by RMCD

- Cigarettes, tobacco, alcohol, spirit, liquor, gambling equipment, vehicles

Sales Tax (SST)

- SST is imposed on all imported shipments

- 5% or 10% unless item is listed as Non-Taxable Goods or the importer has exemption under Person Exempted from Payment of Tax Order

- SST is not chargeable if shipment is moved to a Special Area/Bonded Area

*For non-controlled and non-restricted items with a CIF value of below RM500, no duties and taxes will be imposed. This is referred to as a de minimis value.

DOCUMENTATION

Documents required by Malaysia’s customs clearance include:

Packing List

This gives product details, shipment volume in kilogram or cubic meter, and serves as a checklist to ensure shipment has been packed correctly or not.

Commercial Invoice

This gives total shipment value usually in US dollar. Helps to determine the import duties and taxes, and eligibility of shipment.

If you are shipping without a logistic partner that can clear customs on your behalf, you may need to include the following shipping documentation as well:

- Certificate of origin

- Bill of lading or airway bill

- Insurance policy

- Other relevant permits, licenses, and certificates

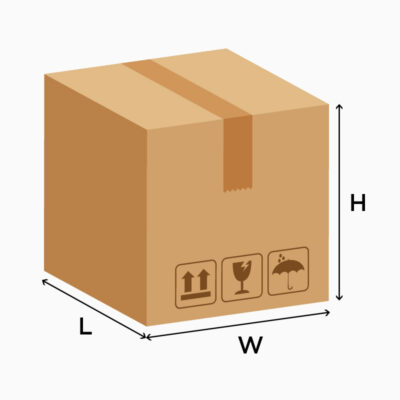

VOLUMETRIC WEIGHT RATE

Volumetric weight or dimensional weight is a specific shipping measurement that determines the density of a package by incorporating both dimensions and weight. It is widely used in the logistics industry around the world to ascertain the density of a shipment when placed in a vehicle or storage area.

Volumetric weight is compared against the actual weight and the higher weight is used to calculate the actual cost.

- Dimensional weight calculation (cm): (Width X Length X Height) / 5000